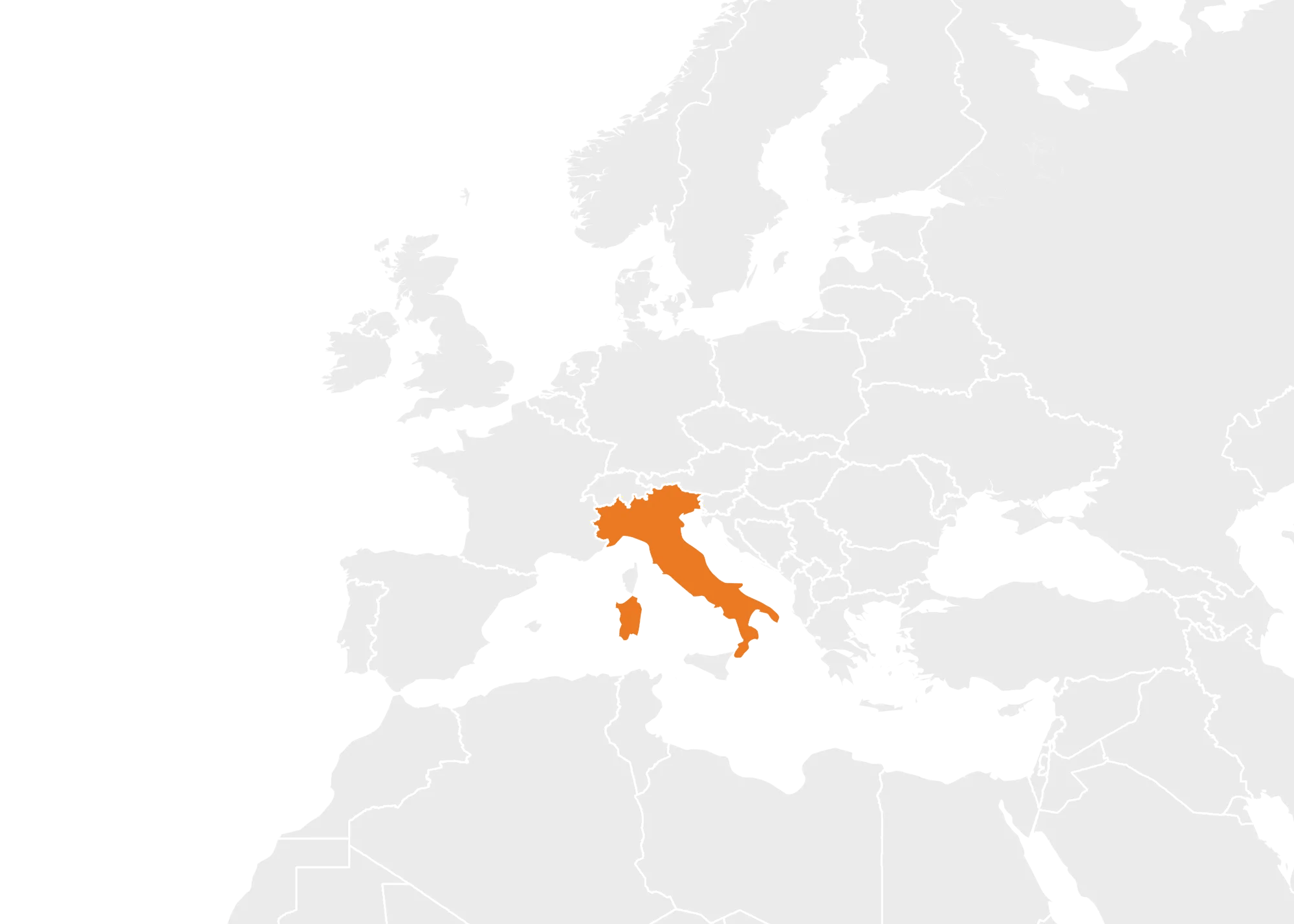

Market spotlight: Italy

A snapshot of California’s market performance, competitive landscape and Visit California programs in Italy

Massimo Tocchetti, Managing Director, Visit California Italy

Feb. 2, 2026

Massimo Tocchetti

Managing Director

Visit California Italy

Market performance

In 2025, air arrivals from Italy to California ports of entry increased 4.4%, totaling 149,000 arrivals. According to Tourism Economics, trips from Italy to California by all modes of transportation are projected to grow 5.4% in 2025, reaching an estimated 188,000 trips to the Golden State. Total visitor spending from Italy is expected to reach $457 million, a 3% increase compared to 2024.

Air capacity from Italy has expanded significantly, up 29% year to date. Direct service includes ITA Airways flights from Rome to Los Angeles International Airport and San Francisco International Airport, as well as Norse Atlantic Airways’ new seasonal Rome to Los Angeles route. These are complemented by one-stop services to both gateways operated by American Airlines, Delta Air Lines and United Airlines.

California’s core appeal for Italian travelers remains strong, led by the Los Angeles and Hollywood experience, San Francisco, coastal destinations, national parks and major theme parks.

Italian travelers show a preference for luxury hotels at 56%, followed by standard hotels at 53%, vacation rentals at 49% and bed-and-breakfast accommodations at 21%. Bookings are most commonly made directly through hotel and rental websites or via online travel agencies. While still a smaller share, tour operator and travel agency bookings, primarily package travel, increased over the past year.

Current marketing efforts are focused on driving awareness of lesser-known destinations, including Northern California’s wine regions, less-visited coastal areas and inland destinations such as Lake Tahoe and Joshua Tree. These initiatives emphasize trade engagement and social media to strengthen direct connections with Italian consumers.

Italy Market Profile

The market profile report contains three sections:

Market landscape section offers a look at spending forecasts, arrivals and airlift to California.

Audience insights includes data on travel behaviors and accommodations and booking preferences.

California traveler and trip details includes data on leisure travelers’ airline reservations and top U.S. visited destinations.

Competitive environment

New York remains the top U.S. destination for Italian travelers. Among U.S. states, California ranked third in 2025, following New York and Florida.

Florida recorded 207,120 Italian visitors in 2025, according to NTTO data on first-intended address, representing 12% growth year over year. Florida’s strong appeal to family travelers and its perception as a more affordable destination present competitive considerations for California as it positions its value and diversity of experiences in the Italian market.

Visit California programs

California’s potential in the Italian market remains underleveraged, as the state is often sold as part of a broader U.S. itinerary rather than as a standalone destination. This limits opportunities for longer stays, geographic dispersal and increased visitor spending.

Rising travel costs remain a concern in this price-sensitive market, particularly for family travelers, a core segment for Florida. In response, marketing efforts will focus on higher-spending demographics, including Gen X, as well as priority audiences such as Millennials, who account for 29% of Italian travelers, and honeymooners.

As direct online bookings and online travel agencies continue to grow, Visit California Italy is strengthening partnerships with key platforms including eDreams and lastminute.com. At the same time, many tour operator packages remain standardized and limited in scope. Visit California is working with tour operator partners to develop more California-focused itineraries that encourage longer stays, currently averaging four nights, increased geographic dispersal to lesser-known destinations and broader audience targeting, including luxury, food and wine and outdoor travel.

Trade education remains a priority, with ongoing efforts to support tour operators through regular training and updates for travel agents.

Media interest in Italy is increasingly shifting toward lesser-known destinations and undiscovered experiences. Visit California will continue to collaborate with journalists and content creators to drive visibility and showcase the breadth of California’s destinations and experiences beyond its most iconic landmarks.